Table Of Content

- What is the fastest way to save money for a house?

- How to Improve Your Credit Score

- Setting aside funds for a down payment on a home? Put that cash in an accessible savings account.

- Buying a house? Here’s an open secret: You don’t need to put 20% down

- Buying Guides

- Don’t forget maintenance costs and fees

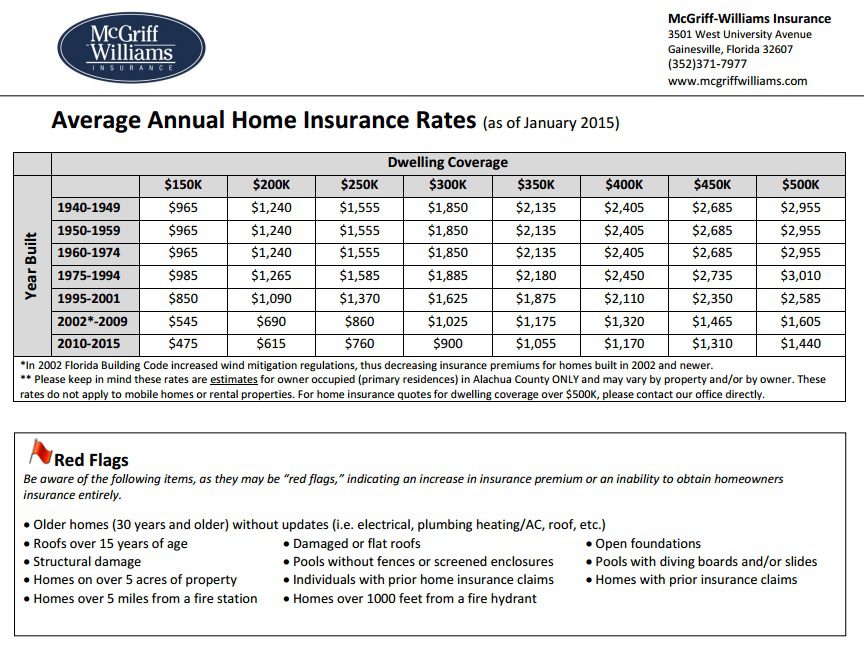

Keep in mind, you may be sacrificing your comfort a little now to live comfortably in your new home later. You should expect to pay between 2% and 5% of your purchase price on closing costs, which are settled on the date of your real estate closing. They could include a variety of fees, such as title-related costs, loan origination points, attorney fees and underwriting fees. Closing costs could also include the appraisal if you didn’t pay for it upfront. You also might need to pay ahead on your home insurance premium and, if you need it, mortgage insurance.

What is the fastest way to save money for a house?

If you give it some thought, you might conclude that some of your monthly ongoing expenses can be eliminated. If you're single, consider living with family or friends for a year. Yardi Matrix, an industry information service, marks the average U.S. rent as $1,642 as of March 2022.

How to Improve Your Credit Score

Sign up for our weekly non-boring newsletter about money, markets, and more. Expect to pay up to $500 for the basic inspection, Sutherland said in an email. You can also opt for specialty services like a pest, radon or mold inspection. These might run your tab up by several hundred dollars but could save you headaches in the long run. Many or all of the products featured here are from our partners who compensate us.

Setting aside funds for a down payment on a home? Put that cash in an accessible savings account.

Say you use 50% of your income to pay for your living expenses. Three to six months of living expenses for your emergency funds would range from $6,300 to $12,600 in the bank. Once you know how much you'll need to save and where you'll park it, you can set a monthly savings goal. Take the total you're aiming to have for a down payment and divide it by the number of months you plan to take to get there. If you're eyeing a $430,000 home—roughly the median price in the US as of the third quarter of 20234—you may want to have $86,000 as a down payment.

How much you need to save will depend largely on how much house you hope to be able to afford. This home affordability calculator can help you settle on a target home budget. Other factors, including where you want to live and the type of loan you get, will also play a role in how much money you’ll need to save. On the flip side, some people may go through life without taking on any debt or opening any credit cards.

Aim to save 20% of the purchasing price

In general, the longer until a purchase date, the more risk you may feel comfortable taking on, as you have more time for investments to potentially recover from losses. To help you figure out an asset allocation to fit with this goal consider contacting a financial professional. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Buying Guides

You are typically required to pay a set amount of money every month for a 12-month term. You usually cannot withdraw your money until the 12 months are up. Buying a house is likely to be the most expensive purchase of your life.

House Of Ashes: How to Save Everyone (Best Ending Guide) - Screen Rant

House Of Ashes: How to Save Everyone (Best Ending Guide).

Posted: Sun, 28 Apr 2024 16:00:00 GMT [source]

Don’t forget maintenance costs and fees

If you’re new to budgeting, it can seem overwhelming in the beginning. After all, how do you determine how much to spend on groceries if this is your first time tracking your money? Accept that your first few budgets won’t be perfect, but keep working to polish your budgeting system.

See all articles about How to Afford a House

Once you identify these triggers, you can make a plan that curbs your spending when the situation arises. For example, take yourself out for a walk or call a friend instead of online shopping. If you’re celebrating a small accomplishment, reward yourself but consider waiting on that new $100 pair of shoes.

Also, if the issuer calls the CD, you may obtain a less favorable interest rate upon reinvestment of your funds. Fidelity makes no judgment as to the creditworthiness of the issuing institution. As for early withdrawals, the IRS may allow you to take out $10,000 of tax-advantaged dollars from a individual retirement account (IRA) penalty-free if you are using that money for a first-time home purchase. Any amount exceeding that may incur additional taxes and penalties. Be sure to account for any existing funds you have earmarked for a down payment.

Include what you bring home, what your partner earns, and other steady sources of money. Before her buyers go all in, she reminds them of how big of a financial commitment a home purchase is. Once you have an idea of how much you might spend on a home, you can start to work backwards to figure out how much you need to save for a down payment. Although only 19% of consumers believe that it's a good time to buy a home, according to a recent survey by Fannie Mae, it's never too early to start building a down payment fund. You could also look into side hustles as a form of supplemental income.